THE WHOLE STORY

My story, the whole story in detail as told to Jon Griffin. Jon Griffin has been Business Editor of the Birmingham Mail since 1998. He began his career at the Peterborough Evening Telegraph in 1975 then worked from 1978-79 for the Birmingham Evening Mail. He later joined the Coventry Evening Telegraph as a trainee sub-editor then the Wolverhampton Express and Star from 1980 before re-joining the Mail in April 1996. He now works as a Freelance Journalist and he and I sat down together to pen this:

BRITAIN was booming in the late 1950’s.

It was a time when the then Prime Minister Harold McMillan told people: ‘They had never had it so good.’

Jobs were plenty but labour was in short supply and so many employers reached out to people from the countries of the old British Empire to fill the gap.

It was a message that reached rural Pakistan where Safaraz Ali’s father, Kharait Ali, worked eking out a living on the family farm.

As with thousands of others the plan was to come to the UK to earn some money before returning to Pakistan, in Safaraz’s dad’s case, to buy some land which he did eventually.

Saf was told by his father that it was possible to earn as much in a factory in Birmingham in a few months as it was in a decade of toil on a farm in Pakistan.

“Dad was going to come back and buy some land which he did, He brought some agricultural land in the Gujranwala district of Punjab,” said Saf.

“My Dad lived a very frugal lifestyle in the UK, like many others at the time.” It was a significant group of young men sharing accommodation and when they were not working there was a lot of time playing popular board games of the time like poker and ludo.

“For him it was about working, enjoying time with his friends, a means to an end,” added Saf.

Working was plentiful and Saf’s was told that at the time it was possible to give up a job in the morning and find another the same afternoon.

My formative years, introduction to Education & growing up.

Saf’s dad got a job with IMI in Witton working in the titanium plant looking after the furnace.

“I have seen a photograph somewhere of him standing by the furnace,” added Saf.

Mr Ali returned to Pakistan in 1962 or 63 but only stayed a few years before being drawn back to the better prospects in Birmingham.

He always lived in the Alum Rock area, house sharing initially and eventually buying the family house in 1969 or 1970.

He went back to Pakistan briefly to get married and brought his wife (Saf’s mum) back to Birmingham and the family home.

Safaraz’s missed out on early year education but because his parents did not know the system and therefore there was no nursery or play group attendance for Saf and he was five-and a-half when he first went to Primary school.

The first two days were ‘shocking’ and were spent crying.

“I did not speak English and because I am the oldest there was no one else who I knew that did,” he added.

“I was terrified, did not enjoy it at all, was scared and did not want to be there.”

Saf is one of five brothers and a sister.

After primary school Safaraz went to Hodge Hill School.

“It seemed like miles away but was only one bus ride,” he added.

At Hodge Hill he said that there were very few other British Asian, there was racism and ‘we were frightened.’ “There were continual struggles and fights and we had issues in terms of riots and skin heads,” he added.

“I got beaten up, there were fights. It was a continuous fight for survival.” “I started playing truant.”

His education suffered and Saf left school without passing any GCSEs.

“I left school at 16 with no qualifications,” he added. “I didn’t think it was going to be that bad and was absolutely shocked by my poor results”.

Saltley Gate, the heart of Birmingham B8, early 80's.

Early 80's, photo taken on Eid.

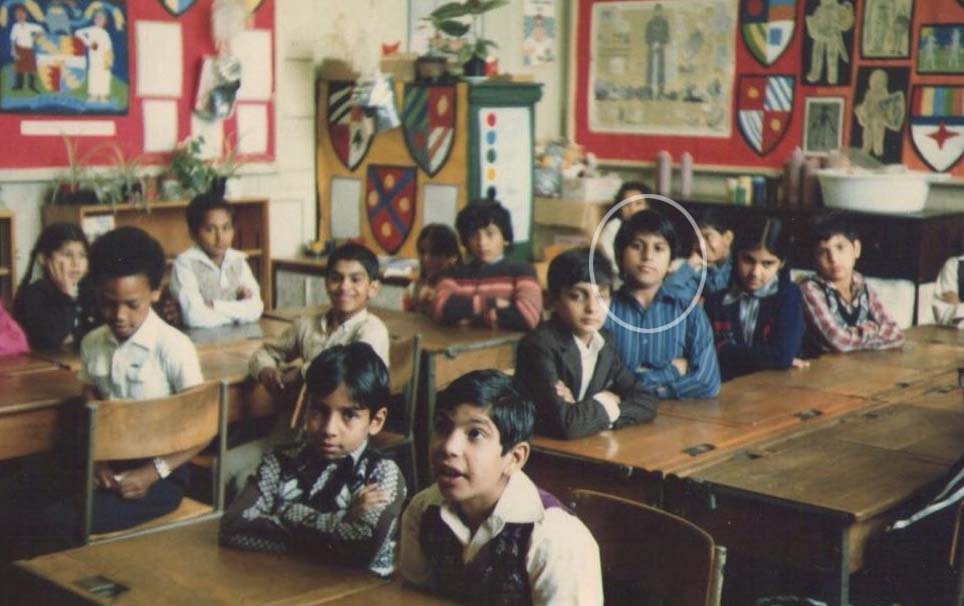

My Junior School Class

My High School/Secondary School Badge makes me so proud

“very polite and courteous, although he is a little quiet at times.”

Finding my own way, through responsibility.

He discussed his options with his father which also involved some life desicison as well as career related conversations.

In this respect Safaraz agreed to an arranged marriage in 1989! That wasn’t something that was planned much in advance but I went ahead with it.

In terms of career conversations: “Father gave advice that there was an opportunity at IMI or a job in a biscuit factory, Unity Biscuits. or try again in education,” said Saf.

At this time father and son became close – “as we were having proper – you know adult type conversations”.

In terms of Hodge Hill School all five brothers eventually went to the same school, and it did get easier for all of them and their children have also gone through the same school.

Safaraz after some real considerations decided to return to education. He took the opportunity to do a BTEC diploma in business and finance and wanted to be an accountant or work in the financial sector,

“It was a life changing experience with getting married, college and extra responsibility,” said Saf.

For the first time he was on the right track but struggled with getting to Bournville College in leafy south Birmingham.

“Bournville College was very good for me. It got me on the right track.”

It provided a vocational qualification for people that had failed their GCSEs.

The following year Saf went to Hall Green College to study for a BTEC National Diploma (European studies).

“This course had a European element. They teach you a language and that was German for me.”

He went to Germany, as part of his studies, the first year was being placed in Bremen with BMW.

“In terms of my personality I was always very reserved but was getting more adventurous; I came out a bit more.”

He was in Germany for eight weeks in the first year and 12 weeks in the second which was spent in Stuttgart and Bonn and included a tour of Germany.

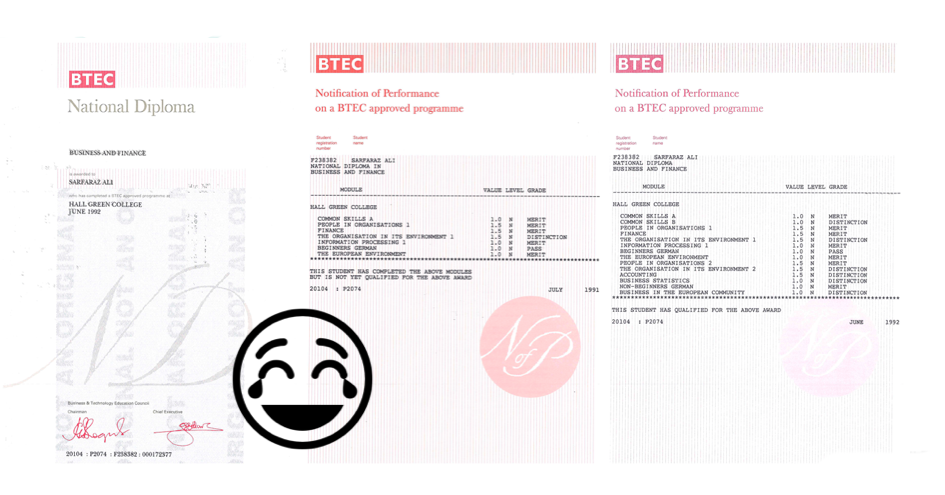

BTEC Diploma in Business and Finance - My pathway to progression

My GCSE results, bouncing back from this!

BTEC Diploma in Business & Finance

Starting to get out there, beginning to find my way

Accelerating, along with learning and a tiny bit of earning!

“Loved it really loved the community, loved the environment.”

Saf had a mentor from the Economic Development Unit at Birmingham City Council. “He had a massive impact because he was doing one-to -one conversations and checking in and supporting me.”

It worked out well because Saf was being paid to study which was important given his family responsibilities.

“I really enjoyed learning and life at that time. I felt like I was winning.”

“I then passed my driving test. Life was brilliant as these little things make a huge difference.”

He got his first job working at Halfords in Selly Oak. It was working in the -in car entertainment section, selling and fitting cassette radios that could be put in and taken out.

“I moved from that department to their bikes division that just started,” he said.

“I have never considered myself a hands-on person, but I had a bike, a Chopper and a Racer bike.”

He was working Sundays and two days a week whilst still at college, but he could not continue because of having to go to Germany so had to leave Halfords and got a job as a security guard with Burns International Security Services. This included a contract with the West Midlands Police, so he was working at a police station at Walsall Road and Nechells being paid £2.42 an hour at the time.

Saf then worked for Securicor that were taken over by Group 4 who eventually became G4S.

“I finished my college qualification and then had to think carefully what I wanted to do.”

He chose to study for a Bachelor of Science in Entrepreneurship but there were not enough people for the course.

”So, I did the BA Honours in Banking and Financial Services at the University of Central England.”

He loved it and excelled at it. Studying during the day and working in the evening as a security guard. This involved a lot of time with not much to do so he was able to take books to work and learn.

“I started reading a lot more and started taking my textbooks. I really enjoyed learning.”

In the second year there was a big change in the family.

Saf used his acumen with figures to suggest his father took an opportunity to leave IMI.

He put the figures on a spreadsheet for his father to “show him” what he can do, “ with seeing the data and the opportunity, the decision was easier for dad”

First steps into my social entrepreneurship journey.

The situation was somewhat reversed from when Saf was young and needed to look at the options.

“I showed him the opportunity and the opportunity cost and that if he carried on working with the tax situation, he would be worse off,” Saf said.

All the time, his father continued working at IMI until 1993 when he accepted enhanced terms to take early retirement.

In the end he took a reduced pension and lump sum.

“There was a package of £90,000 which was a huge amount of money”

It was a lot of money and feeling himself too young to really retire Mr Ali started looking at what business he could go into and that resulted in buying a shoe shop on Coventry Road in Small Heath.

“We were one of the very few independent shoe shops at the time,” added Saf.

“We did the whole thing, what was he good at what were his strengths. He could not read; he could fill in a form. He could read and write.”

Some type of retail looked the best option but what kind of retail? Initially they considered a food store or newsagents.

“We looked at something that had higher margins, more of a lifestyle business.

“The options came back to a shoe shop, a takeaway or he was considering a travel agency.”

Father and son went to the library to get a list of suppliers, wholesalers and distributors.

They visited Lancashire, Northampton and Leicester and found the best suppliers were in Bury.

“We actually brought the shop in 1993. By that time, I had already started university.”

The shop was in Coventry Road and they brought the freehold for £38,000 and then had to buy stock.

“I was not working in the shop, I did the paperwork, I did the stock system, inventory and helped with accounts.”

It was called Universal Discount Footwear (UDF).

At the time Saf was a full time student doing the BA Honours degree.

“I gave up my security work so I could guide and do the back office function for the shoe shop. Inventory management was my thing.”

Initially, the shop was a success working on 50 per cent margins.

The beginnings of a lifelong partnership.

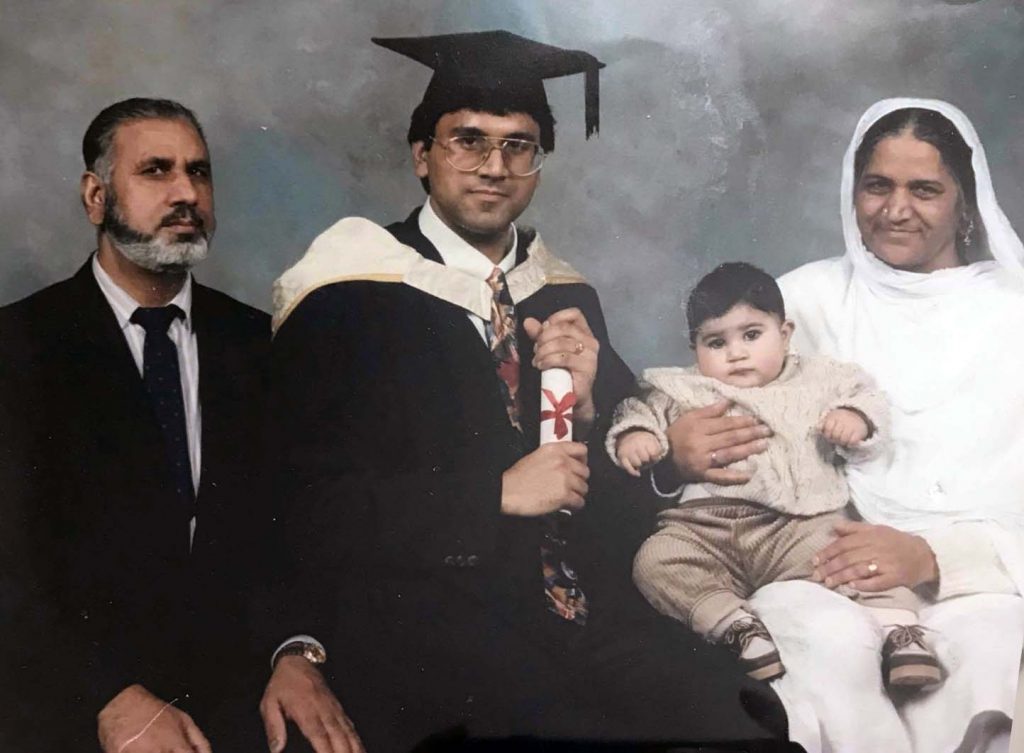

My first daughter and I at my parents home in Alum Rock, B8.

My son and I, with our 'thoughtful' face on.

But it was not that simple and Saf’s father thought the shop was making more money than it was.

They were required to buy a box with different sizes but some did not sell. Larger sizes were not selling.

“It looked like we were making money, it felt like we were making money and we were making money but not as much as we thought.

“My job was essentially the manager but I was there all the time. It was a steep learning curve.”

Saf took a year out from his degree course to work full time in the shop.

They had to get rid of some stock and recover from the mistakes that had been made.

“We bought too much stock, the wrong kind of stock, the wrong sizes.

“The last year was the toughest year, people were going into town, our main competitors were Bacon and Bensons Shoes.”

Faced with having too much stock, they were unable to bring in new stock and so there was no option but to off-load shoes to market traders and take the best price they could get.

Saf’s first child, a daughter, was born in 1996, also the year he completed degree.

By this time, his father was in his late 60’s and wanted to retire and go back to Kashmir which he did.

They looked for an exit strategy and considered options such as bringing a partner in.

“We reduced the stock and sold the lease,” added Saf.

“My father has gone to Kashmir and started building a house there. I finished my course and started working for Transco in 2007.

“At that time British Gas had split and had a company called Transco.”

He was based in Homer Road in Solihull.

“I did that for a while and then got an opportunity to work for Sandwell Council.

“This job was a good opportunity for me.”

He was budget support officer for social services at Sandwell Council in Smethwick in 2008, He was involved in outsourcing. It was a tough time with budget cuts, and found himself in the frontline with the transformational changes that were happening and many changes with most social workers against these changes.

“Social work is a high-pressure environment, a lot of them were going off sick.”

A proud moment at my graduation.

Another proud moment with my daughter.

The Education Sector as a career.

Voluntary work opened up opportunities...

Getting serious for business and grasping opportunities.

“I was involved in the tendering and procurement and the management of outsourcing.

“Our job was to make sure that we got best value for money, negotiating the deals.

“The local authority needed to pass the service delivery onto the private sector because it was costing too much.”

At the time the cost of providing care internally was £27 an hour compared with £10-£12 an hour outsourcing to an external care provider.

This was an insight into home care but, at this time, Saf was not thinking of setting up as an entrepreneur.

“I was not a natural entrepreneur and didn’t really see or notice opportunities that were in front of me.”

Saf used to buy the local paper- the Birmingham Evening Mail on a Thursday to look at the opportunities and saw a job as a pension reviewer with Britannic Assurance.

Britannic Assurance had a regulatory issue looking at past businesses.

“They had a massive review that they had to take on.”

Saf was based in Wythall on the outskirts of Birmingham.

At this time he started volunteering with two colleges.

“Volunteering for me initially was about making improving my career prospects, I wanted something that looked good on my CV.”

“I had got a lot of time on my hands. In the previous job I could take work home but here you had to work on the files and could not take them home.”

He volunteered to work at colleges helping them to increase their community engagement.

“They were looking for people who could come in and get involved sitting on panels that reported to governors.

He had a budgets to go out and work with communities including adult education.

“I was going into mosques and temples representing the colleges. I introduced a number of organisations to the colleges.”

The colleges started working with local authorities and were getting funding for this.

“The colleges were looking for more community workers, they called these franchises at the time. Colleges were funded by the Further Education Funding Council.”

“Because I was able to make relationships with people. I got involved with some of the Executive team at the Colleges – working at the Senior Leadership team level.”

It was suggested that Saf could become a franchise partner. “I became a franchise partner of Matthew Boulton College, which I did working with two work colleagues and friends from Britannic Assurance.”

They setup up a company and became a franchise partner delivering adult education courses.

Matthew Boulton gave offices for the business Community Education and Training Network that led to Pathway College that is now Pathway Group.

One partner in the business had worked for British Airways as a crew member on the London to New York service and the other was a student of Law!

“We were delivering English Language Courses, English Language for Speakers of Other Languages.”

“These were predominantly asylum seekers and refugees. There were three big refugee communities, the Somalian, the Iraqi and the Afghans.

“I did not regard it as a business. I did not regard myself as a businessperson, It was just about doing good delivering impact as well and developing my skills sets and contact base .”

They moved from Matthew Boulton to other colleges and had a main contract with South Birmingham College. Then they moved to Sandwell College.

There were Government rules changes, new funders, the Learning and Skills Council that had less interest in working with refugees and so they ‘mothballed’ the business.

Safaraz then took the opportunity of launching his own business in its own right in financial services as a mortgage broker.

“I was self-employed and worked as an appointed representative in 2013”

“I already had a lot of the qualifications.”

Up to this time Saf’s previous experience in financial services was in general compliance.

“I had to reinvent myself.”

“I gave up my job at Britannic Assurance, my other partners resigned. We were working from our offices in Stratford Road. Within a year the market had changed and the funding had changed.”

Government stance was against funding asylum seekers and refugees.

“Because the funding changed, we were left holding leases and premises in 2013”

The business had been training 4,000 people a year and turnover was a very positive £200,000 annually.

It was a time of crisis.

They had given up their other jobs and thought it was going well but the unforeseen happened.

At home Saf’s family was growing, his first daughter was born in 1996, second daughter 1999, third daughter 2001 and a son in 2006.

He then found some work as a contractor in 2004 and 2005, using his compliance knowledge.

“I was doing compliance, training up financial advisers and at the same time checking up paperwork.”

He was also involved in investigating the mis-selling of endowment mortgages. This involved working away from home for months on end – including over 6 months in Cardiff.

“This definitely needed to be for the short term with the aim that this will lead me led to a major change of direction”.

“I thought to myself what can I do and I looked at and revaluated the home care market.”

Home care was being increasingly outsourced to the private sector. About 50 per cent outsourced and ‘demographics looked good.

“I saw there was an opportunity here. At the time I had the four children, debts that I had got to pay.

“There was no money, we were on our knees. I had debts from the adult education business.”

At the time, Nationwide Care Services Ltd was born, initially with his two original partners taking the lead and then Saf joined and started working full time with NCS.

The company was set up in May 2005 and Saf joined full time later in the year.

The first contract was the with the Local Authority in Coventry.

“This was providing carers for individuals in their own homes.”

“The outsource provision of home care where the carers are employed by us and we have a contract with the local authority to provide the care. We manage control and provide the care on their behalf.”

Nationwide Care Services was very small: ‘we had no track record.’

It was a case of picking up small contracts for work where the existing tender provider were unable to pick up or cover that care.

“We were hungry and very solution focussed and need to build a track record.”

“It was not about can we make it profitable from the start but establishing a track record.”

In 2007 there were more tough times. Saf had a health scare due to the relentless focus on the Care business, in that year his father also died. His father was 71 when he died, he had been in Pakistan building his retirement home and fell ill and the family brought him back. Mr Ali had been suffering from cancer.

“He lived the last few months here.”

Saf’s own health care was in part a result of the pressures working in a business that makes tough emotional demands.

“We get a new client; we go to that person’s home and do a care plan. I was part of the team doing the care plan.”

“Not just dealing with older people but younger people. Seeing people in tragic circumstances, young people that had strokes and heart attacks.

“My health deteriorated.” Safaraz had angina, a condition in which blood flow to the heart is restricted.

“At the age of 34, I was just about to have a heart attack because of the stress of the home care.”

“This was combined with father’s ill health.

“I was in hospital for a while.”

As part of his recovery plan Saf did a lot of walking and this gave him valuable thinking time.

At this time the then Labour government introduced ‘train to gain’ funded by the Skills Training Agency.

Saf learned about this listening to BBC Radio 4.

The previous education and training business morphed into a new name and Pathway was first used in 2003.

“Our biggest strength was that because of Nationwide Care Services, we were an employer in our own right.”

At that time they were employing about 100 people in Nationwide Care Services.

Saf was able to draw on his previous experience in the training market.

“I thought we can deliver the training for ourselves.”

“So, I knocked on the door of Business Link and said: ‘we can do this.’”

He prepared a proposal and was assisted by Business Link to get a contract.

“So, we managed to get a contract for ‘train to gain’ to deliver level two NVQ qualifications.”

“This was the rebirth of the training business and now being called Pathway and I had moved from Nationwide Care Services where I was hands on, recovering from my ill health to reinventing a training business now as Pathway College and then later on as Pathway Group.”

Safaraz is still actively involved in Nationwide Care Services mainly as his role as Chair but focuses more of his time on Pathway.

Pathway was delivering training including NVQ level two in health and social care and customer service.

Train to Gain that had been a Labour Government initiative was then replaced.

The Government started focusing on apprenticeships.

Apprenticeships went through regulatory and image change. They had traditionally been blue collar but were expanded into other sectors.

By this time Saf was spending most of time working in the Pathway Group.

“We were able to move into the apprenticeship market as an apprenticeship training provider.”

Whilst Saf is hands on at Pathway he continues to have board responsibilities with Amington Holdings Ltd which incorporates the Nationwide Care Services business and has more than 800 employees, a pharmacy and technology business.

The turnover of Amington Holdings is circa £20 million a year.

“We have near doubled the size in three years, relentlessly focusing on scaling up”

“It took from 2005 to around 2018/19 get to get to £10 million. In 13 years, we took it to £10 million. It took another three years to add another £10 million.”

The business provides domiciliary care to thousands of customers. It allows them to have the support they need to continue to live at home.

Some care is funded by the NHS and local authorities.

“We deliver 25,000 hours of care a week and could be going to a customers house four times a day.”

“Our employees work for us Nationwide Care Services and delivering care for NHS and Local authorities who are responsible for care services but often commission from independent providers such as us.

“Everyone has the right to have a personal budget.

“Nationally we are not one of the biggest. We are a generally a mid-range care provider. There has been a lot of consolidation, a lot of private equity coming in to this market and we are seeking further growth through a buy and build strategies.

The sector is dominated by large independent providers where some are franchised.

Corporate providers are doing the volume but there are less of them.

“We have come a long way, we are an independent provider, we want to stay independent, we don’t want to be gobbled up – at least not for a long while yet!.”

Infact the business is looking to expand by acquiring smaller providers.

Nationwide Care Services is the second biggest in Birmingham and the biggest in Solihull.

It is also working in the east and west Midlands, Nottinghamshire, Derbyshire, Leicestershire and Worcestershire and has invested heavily in technology including developing its own app and rostering system.

“We are looking at automation and how we can provide extra value in terms of personal care.”

“Pathway Group have gone from £4-£5 million annual turnover where we have been for fout to 5 years and again with my scale up focus, I am seeking to take it to 10 million next year”

With Theresa May at Whitehall for Eid.

Safaraz speaking at the Asian Apprenticeship Awards

It had to restructure and regroup in 2018 with further changes in 2020 “due to some wrong hires and focus”.

“In 2018 my plan had been to focus much more on Nationwide Care Services as that had much more opportunities”

“But Pathway instability and issues bought me back in to the business and I had to make a lot of cuts because we were heavily haemorrhaging money.

“The problem was that some of the projected earlier growth had not materialised, and we were carrying a lot of costs, a lot of staff particularly at management level and they were not making much impact”

“We had expanded without refocusing and set up some stupid things like a nail bar.”

Redundancies could not be avoided and 140 people went down to about 50 but numbers have now come up again.

Pathway now delivers training in London Manchester, Stoke on Trent, Leeds, Bradford and Redditch.

“We are also delivering digital marketing”.

“We also work with HS2, training people up to work in the rail sector.

“The beauty sector is growing, largely self-employed beauticians working from home and in salons.”

“We also work in the welfare to work arena with people that are long term unemployed.”

Pathway is a sub-contractor to Serco and other big name providers.

Saf is also involved in charitable work including a football academy for young people in one of the more disadvantaged parts of Birmingham – namely B8 and B10 areas of Birmingham.

“Again, that’s a way of giving back to the community we are from.”

Saf was founder of the Asian Apprenticeship Awards which later became the BAME Apprenticeship Awards and now are called MultiCultural Apprenticeship Awards. He is a judge for a number of important business events including the Birmingham Awards and the Great British Entrepreneur Awards.

He is founder partner of the Business Book Awards and is focusing on the growth opportunities in the Saf is author of the ‘Canny Bites’ business books and a podcaster.

Interested in politics and policy, he is a moderate compassionate Conservative, believing in hard work and aspiration but recognising that the state has responsibilities to those less fortunate.

“The business has moved from slow organic growth to a much more expansive growth – A fair amount of our effort has been on scaling and scaling up and in this respect we have had to had to learn and relearn.”

He has an optimistic outlook but knows there will always be bumps in the road.

“It has been a journey, a bit of a roller coaster ride.”

“Margins are really thin in social care and if things go wrong, they can go wrong very quickly.

“Consequences are very high, dealing with people’s lives, public funds, reputational risk.”

Likewise, the education and training landscape is in an almost permanent state of change.

As Saf has learned, coping with change and turning challenges into opportunities is a big part of business.

He has labelled himself as the MAD Entrepreneur, Make a Difference, entrepreneur.

That is the big driver in all that he does.

Some of his lessons/nuggets of wisdom that he has learnt along the way he summarises in the end of our conversation as

“Learn not to make emotional decisions based on other people’s choices”

and “many successful being and individuals that get things done will make enemies and have haters- this is a given”

“Remain focussed, don’t diversify too quickly, aim to double down first”,

“Focus on putting more of the same eggs in your basket as long as you and watch that basket carefully and don’t forget to take some soundings in what you do”

In terms of business focus he states he is seeking acquisitions in the health and social care sector in the first instance and seeking to launch their technology business commercially as well as ensuring the future of Pathway Group in a very turbulent market is secured.

The above words were recorded in an interview with Jon Griffin, Thank you Jon for your support.

Safaraz

Some of my Achievements & Proud moments

British Citizens Award awarded to me, with two great team embers, Cathy and Hira

Pakistan International Achievement Awards Winner for 'Best Brand of the Year'

A great team achievement by Pathway for winning best provider of the year and the most innovative provider

Birmingham City Council citizens award by the Lord Mayor of Birmingham

With one of my heroes, John Major one of the best & most under-rated politicians of his time

Meeting inspirational leaders

Saf And Sajid Javid at the time, Secretary of State for Health and Social Care

Saf with Bob Warman & Quantum Club dinner Guests

Saf with Rami Ranger, Baron Ranger

Saf and Charles Mullins OBE

Saf with Bob Warman at a Birmingham Press Club lunch

Saf with the then High Sheriff of Oxfordshire is Imam Monawar Hussain, MBE DL FRSA

Saf in conversation with Lord Paul

Saf and the Right Honourable Philip Dunne MP

Saf with Ninder Johal DL

Saf with Dame Asha Khemka DBE DL

Saf with Rishi Sunak at the time, Chancellor of the Exchequer

Saf with Penny Mordaunt, at the time, Minister of State for Trade of United Kingdom

Saf with Andy Street, Mayor of the West Midlands and a guest at the BAME awards in 2021 at Edgbaston Stadium.

Saf with Wendy Morton MP

Saf in conversation with Lieutenant Colonel the Right Honourable James Cleverly MP

Saf in conversation with Nazir Afzal OBE, former prosecutor with the Crown Prosecution Service

Saf With Paul Scully MP and Gary Sambrook MP

Inspiratioonal Places

Houses of Parliament on the banks of the river Thames

Copyright © 2022-25 Safaraz Ali. All rights reserved. site by expressive design | web design Birmingham