Pharma Venture Holdings Ltd:

Investing in the Future of UK Pharmacies

Pharma Venture Holdings believe pharmacies are more than just dispensing businesses—they are critical to the future of healthcare.

Our reason or being is to acquire, invest in, and modernise pharmacies that align with the new direction of travel in the sector.

We are actively acquiring independent pharmacies that are doing 6,000 scripts plus.

For pharmacy owners considering an exit, we provide a reliable, ethical, and structured solution—ensuring that their legacy, staff, and patients remain in good hands.

For private investors, we offer a data-driven, high-growth private equity opportunity in a sector that is stable, essential, and well-positioned for transformation.

The UK’s pharmacy sector is at a pivotal moment, shaped by demographic shifts, policy changes, and technological advancements. The population is ageing rapidly, with over 20% of the UK population now aged 65 or older. This has driven an unprecedented demand for medication, long-term healthcare, and pharmacy-led patient services.

The role of pharmacies is evolving. The Pharmacy First Scheme, with its £645 million investment, is just the beginning of a broader shift. The NHS is decentralising services, moving more diagnostics, minor ailments, and primary care functions to pharmacies, creating new revenue streams. The demand for digital healthcare, automation, and private services is also transforming how pharmacies operate, deliver services, and generate income.

Pharmacies Are Becoming Mini-Healthcare Hubs

The NHS is shifting more primary care responsibilities to pharmacies, making them the first point of contact for many patients. Those who adapt will thrive.

Digitalisation & Automation Are No Longer Optional

The next wave of pharmacy success will be driven by robotic dispensing, AI-powered supply chains, and remote consultations. Pharmacies that embrace automation will see higher profit margins and lower operational costs.

Private Services Will Become a Primary Revenue Stream

With NHS contracts under financial pressure, pharmacies will need to expand into private healthcare, including vaccinations, blood tests, and specialist treatments.

Market Consolidation Will Accelerate

Larger pharmacy groups are already offloading underperforming sites, while smaller independent owners are looking for exit strategies

Our Differentiator: What Sets Us Apart?

Unlike traditional buyers, Pharma Venture Holdings Ltd is not just acquiring pharmacies—we are investing in their future.

✔ We Are Operators, Not Just Investors – We bring hands-on experience in running pharmacies, ensuring that each acquisition is optimised for long-term success.

✔ We Provide a Smooth, Ethical Exit – We work directly with pharmacy owners, ensuring a fair valuation, a structured transition, and continued support for staff.

✔ We Focus on the Future – Our approach is built around automation, digital healthcare, and private service expansion, ensuring long-term resilience and growth.

✔ We Invest in People – Unlike some buyers who seek quick financial returns, we aim to retain staff, invest in training, and grow the business strategically.

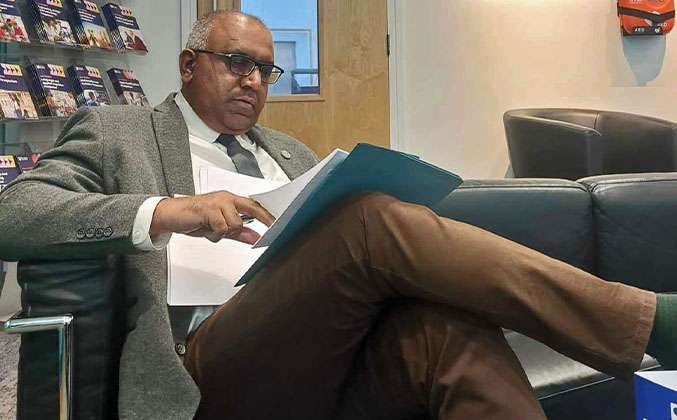

Chris Walker, MD of expressive design in conversation with Safaraz Ali.

Chris W: What are the changes and the challenges in this Sector and What’s your Why?

Safaraz Ali: The UK pharmacy sector is changing fast. Pharmacies are no longer just places to pick up prescriptions—they are becoming mini-healthcare hubs, taking on more responsibility from the NHS. More people are now visiting pharmacies instead of GPs for minor ailments, vaccinations, and health advice. This shift is creating huge opportunities, but it also means pharmacies need to adapt or risk being left behind.

One of the biggest changes is digitalisation and automation. Technology is no longer a choice—it’s a must. Robotic dispensing, AI-powered stock management, and online consultations are already reshaping the industry. Pharmacies that embrace automation will cut costs, improve efficiency, and stay ahead. Those that don’t will struggle with rising operational challenges.

Another major shift is the rise of private healthcare services. With NHS funding under pressure, pharmacies need to diversify their income. Offering private vaccinations, blood tests, and diagnostic services is key to long-term success. More patients are willing to pay for faster, more personalised healthcare, and pharmacies that tap into this will thrive.

We’re also seeing market consolidation. Large pharmacy groups are selling off underperforming stores, and independent owners are looking to exit due to rising costs and workload. This presents a huge opportunity for investment, as well-run pharmacies with the right strategy can be highly profitable and future-proof.

At Pharma Venture Holdings Ltd, we’re investing in the future of pharmacy. We acquire and grow pharmacies that embrace technology, expand services, and adapt to the changing market.

Chris W: Safaraz, what makes the UK pharmacy sector such an attractive market right now?

Safaraz Ali: The market is highly resilient, with 90%+ of pharmacy income coming from NHS contracts, making it recession-proof. At the same time, we are seeing a surge in acquisition opportunities, as many independents look to exit due to workforce pressures, regulatory changes, and economic factors.

Private Investors are seeking to invest, and pharmacy goodwill values are holding reasonably well.

Chris W: What’s your message to a pharmacy business owner?

Safaraz Ali : If you’re a pharmacy owner thinking about selling or even an investor looking for a great opportunity, we’re here to help. We take a straightforward, ethical, and future-focused approach, making sure every deal is good for business, good for people, and good for the future of pharmacy.

Copyright © 2022-25 Safaraz Ali. All rights reserved. site by expressive design | web design Birmingham